Mobile Check Deposit

Deposit checks using the camera on your smartphone or tablet

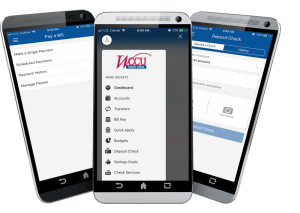

Log into the WCCU Mobile App on your iPhone or Apple Device or Android Device and make deposits into your account. (You will use your Online Banking username and password to log into the app.)

Most deposits are available on the same day. If it’s after hours, the weekend or a holiday, we will process your deposit the next business day.

Get your check ready:

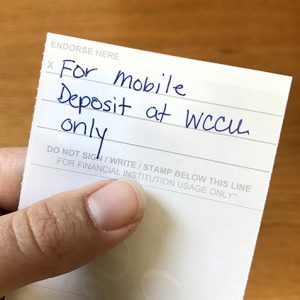

All checks submitted through WCCU Mobile Deposit must be endorsed on the back of the check with the following words: For Mobile Deposit at WCCU Only

If you do not use this form of endorsement, the check may be rejected. The endorsement would need to be corrected and the check re-deposited.

Get your device ready:

Open the WCCU Mobile App and log in. Look for the “Deposit Check” icon in your app.

Tap “Done” in the upper right corner once you’ve reviewed all the reminders for the Mobile Deposit Procedures.

Select your deposit account. Record the amount of the check. Tap “Check Front” when you are ready to take the photo of your check. Your device will automatically take the photo. See the tips below for advice if you are having trouble taking the photos. Tap “Check Back” to take the second photo, and then select “Deposit Check” to complete your Mobile Deposit.

When taking the check image:

- Use in a well-lit area, free of any clutter, to prevent shadows or poor image quality.

- Keep hands clear of the check while taking the images to avoid pictures of fingers/hands.

- Bright but indirect light is best. Placing the check too close to lighting sources may cause shadows.

- Any surface of a solid color that contrasts with the check is best. Use a dark-color surface for light checks; a light-color surface for dark checks.

- Hold your device as still as possible and wait for the app to take the picture for you.

- The payee name, dollar amount, date, MICR data (the characters at the bottom of the check) and other details are clearly legible on the front check image.

- The back check image must have an endorsement that is clearly visible. The endorsement must say “For Mobile Deposit at WCCU Only”.

You will receive an email to confirm your check was submitted. If your check is rejected, an additional email will be sent to notify you.

The total amount of deposits made (less any holds that apply according to the Funds Availability Policy, up to your available deposit limit), will be credited to your account.

On normal business days, checks deposited by 9:30 am will be available by 10:30 am and deposits made by 3:00 pm will be available by 5:00 pm.

Any deposits made on a weekend or after 3:00 pm will be credited on the next normal business day at 10:30 am.

We recommend holding on to the check, or a sufficient copy of the front and back of it, for 60 days in the event of a deposit dispute. After that, we encourage you to shred the check.

There is no limit on the number of checks deposited, however, the maximum allowable amount per day is $10,000

Only single-party domestic checks made payable to the owner(s) of the account may be deposited.

The following is a list of unacceptable items that may not be deposited using Remote Deposit:

- Checks written off a WCCU account made payable to the same member (a member cannot use MCD to deposit a check written to themselves from a WCCU account). A member may write a check from another financial.

- Third Party Checks (checks payable to someone else, endorsed and signed over to you).

- Returned Checks – Any check that you deposited that is returned to us not payable as a result of insufficient funds, stop payment, or other related reasons.

- Altered Checks – Any check that contains evidence of a change (correction fluid, crossed out amounts, etc.) to information on the face of the check.

- Foreign Checks – Any check that is issued to you and drawn on a financial institution in another country (Canada, France, etc.)

- Stale Dated Checks – certain checks contain instructions such as: “Void 90 days after issue date”. If no instructions are contained, then the check is stale 6 months after the issue date.

If you have additional questions, please contact any of our offices and we will be happy to assist you.